s corp tax calculator excel

This application calculates the. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses.

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

The S Corporation tax calculator.

. There is not a simple answer as to what entity is the best in terms of incorporation. For example if you have a. 95741 AGI 2247134 Total tax 7326966 Whats the tax savings between these two scenarios.

Feeling confident that starting. Completing a tax organizer will help you avoid overlooking. Payroll Tax Income Tax 2247134 After tax income.

An S corporation S corp is a tax status under Subchapter S of the IRS tax code that you can elect for your limited liability company LLC or corporation. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3. Bookkeeping Records If you.

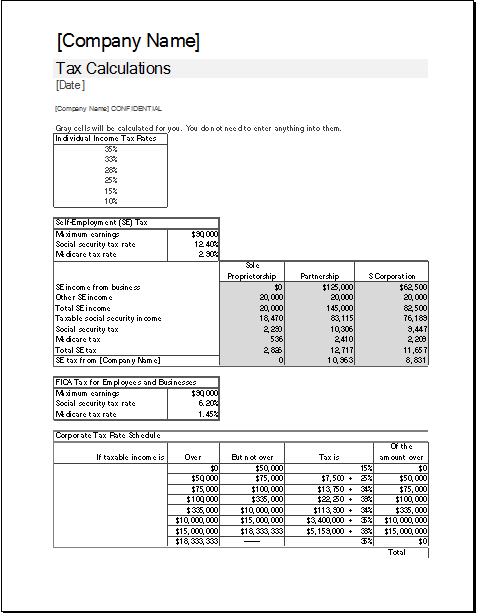

Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. However if you elect to. Just complete the fields below with your best estimates and then register to get your CPA or schedule a free.

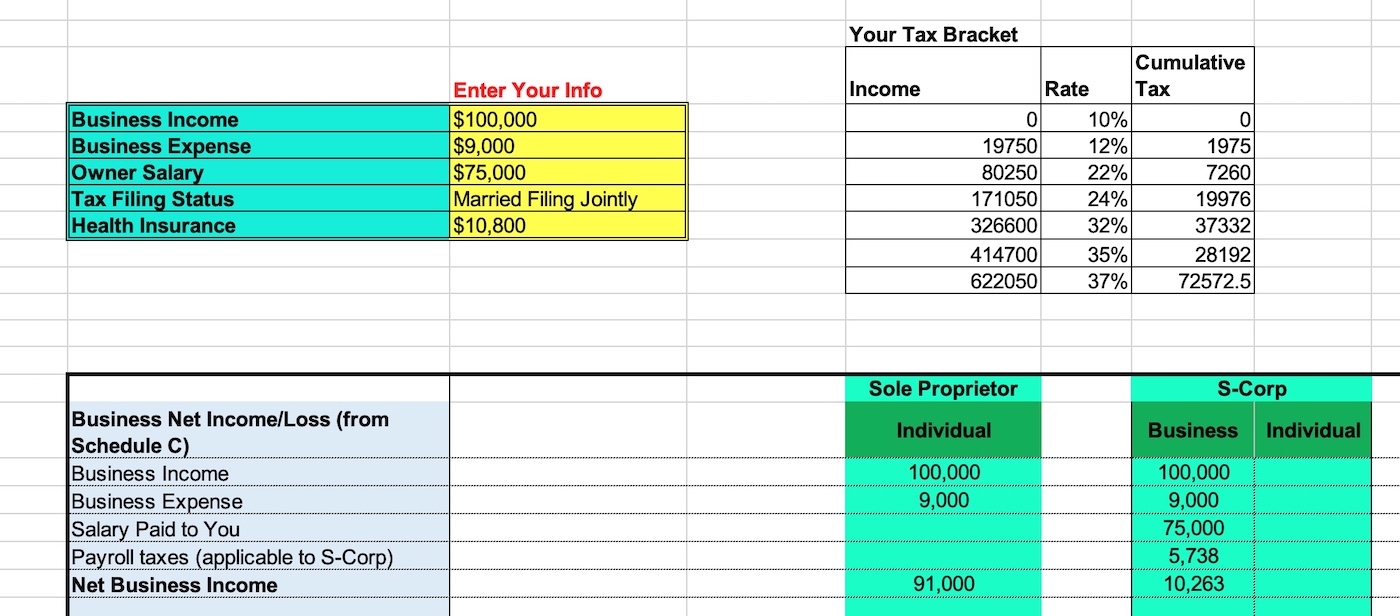

Forming an S-corporation can help save taxes. S Corp Tax Calculator. The S-corporation Tax Savings Calculator allows you to compare SOLE-PROPRIETOR VS.

As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. If your business has net income of 70000 and youre taxed as an LLC you will owe nearly 10000 in self-employment tax. Free estimate of your tax savings becoming an S Corporation.

Corporations calculate their tax using this workbook and submit their files for legal proof of tax being paid. Being Taxed as an S-Corp Versus LLC. From the authors of Limited Liability Companies for Dummies.

We are not the biggest. S corp status also. Initially the basis is the cost of the property but in an S corporation the basis can change as a shareholders investment changes.

Calculator for taxation LLCs vs. But as an S corporation you would only owe self-employment tax on the 60000 in. File irs form 2553 which elects your corporation to become an s corp.

Prior Years Tax Returns If you are a firsttime tax client please provide a copy of the corporations tax returns for the past 3 years Federal and State. Enter your tax profile to get your full tax report. While a C corporation stock basis stays the.

Calculate taxes for LLCs corporations electing Subchapter S tax treatment S-Corps and corporations not making Subchapter S elections C-Corps. This calculation tool of corporate tax calculator is what is called Excel workbook. The S Corp Tax Calculator.

S-Corporation Tax Calculator Spreadsheet--When How the. This calculator helps you estimate your potential savings. Click here to download the mba excel tax liability estimator.

The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the. Here is a calculator which allows.

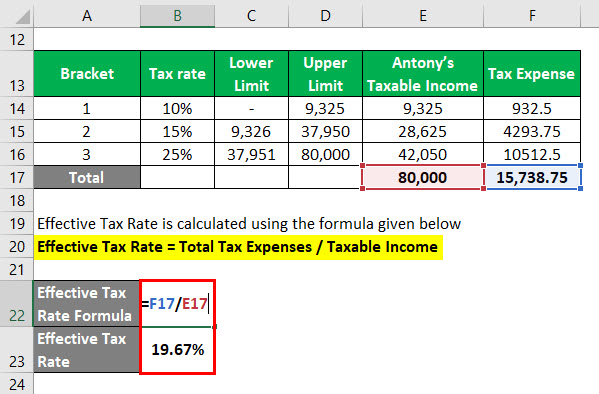

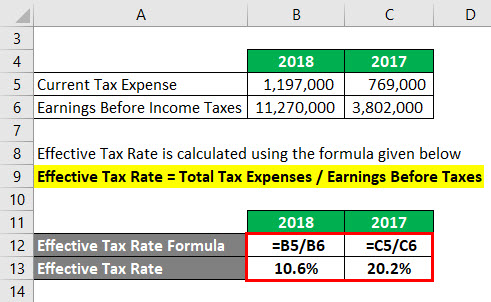

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

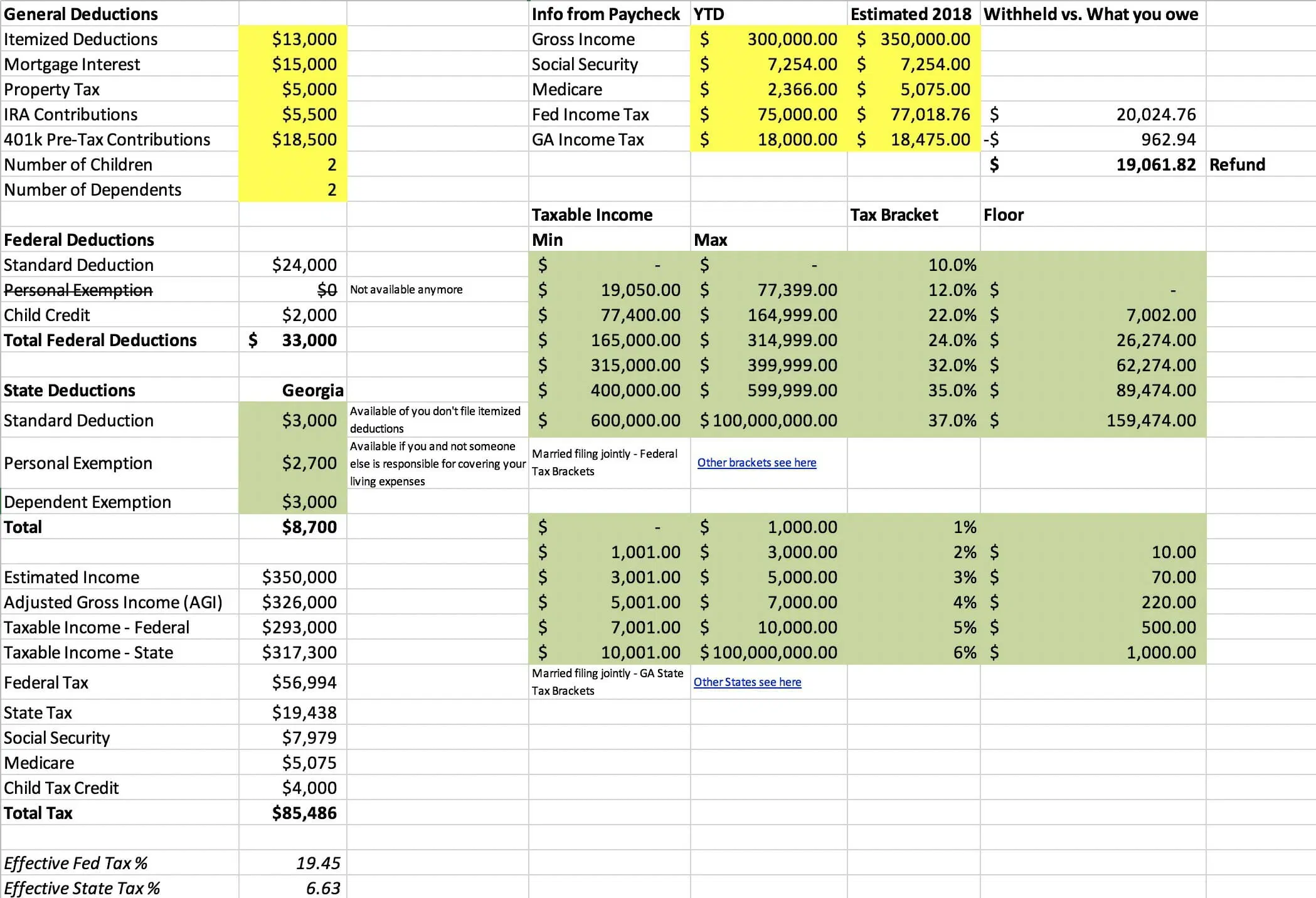

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

Effective Tax Rate Formula Calculator Excel Template

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

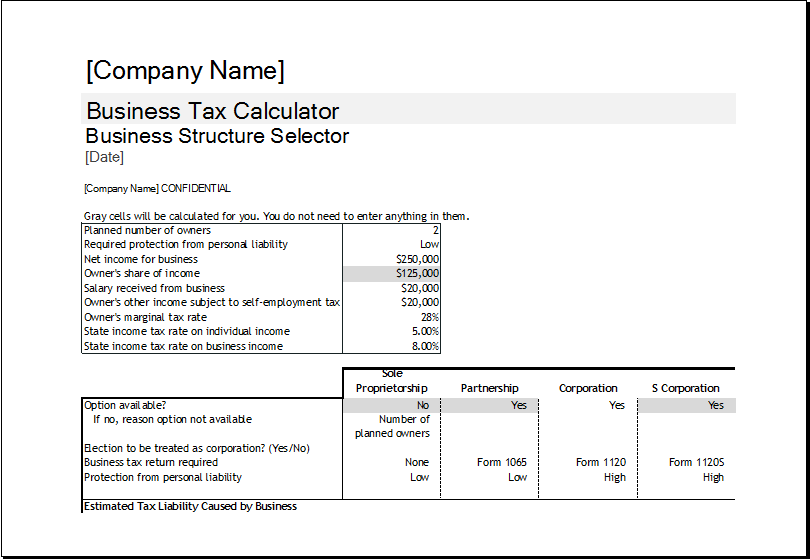

Corporate Tax Calculator Template For Excel Excel Templates

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Corporate Tax Calculator Template For Excel Excel Templates

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

The Basics Of S Corporation Stock Basis

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Excel Formula Help Nested If Statements For Calculating Employee Income Tax